Zimbabwe: A Ripe Investment Destiny?

The recent craze witnessed in the largest Initial Public Offering (IPO) ever of Uganda’s Stanbic Bank and supply beating demand by non-Ugandan nationals, cites the underlying appetite for equities by investors. The euphoria that has hit Africa’s emerging markets signals that there is a lot of anticipated regional market growth that could heighten activity in the coming years providing a platform for more cross-listings and an emergence of merged markets.

More and more Kenyan’s are poised to stretch out as regional markets open up. With the knowledge divide, Kenyans could benefit more from regional opportunities and changing investment trends. Of Africa’s interest are emerging markets with the likes of Kenya, Uganda, Zambia, Botswana, Rwanda and a market likely to emerge from a tainted image of the past- Zimbabwe.

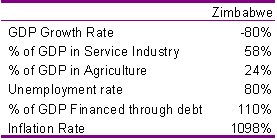

I am keen on Zimbabwe. To many, Zimbabwe is a perfect example of failed democracies in the world. That not withstanding, present challenges could be a future opportunity to explore gold mines. Before we even venture into the country’s potential and future challenges, let us sample some simple statistics from the CIA Fact Book and other reliable sources:

Going by these statistics, one would consider Zimbabwe as the last investment destination to explore. However, there is some ray of hope. In 2006, the country embarked on major reforms that are set to bring the country out of the dark. Among them is the Project Sunrise which revalued the country’s currency and adopted a new one. The country has also embarked on development of infrastructure, banking laws and forex mobilization which is encouraging people to use stable currencies. They have also set the Zimbabwe investment Authority which seeks to promote investment in the country.

Through the efforts, the debt owed to Zimbabwe has dropped by a considerable 2.3 percent. A document on National Export Strategy was recently released and seeks to promote import substitution and value addition.

Future expectations have also sparked a lot of activity at the bourse. The country has over 65 countries listed in the Zimbabwe Stock Exchange and the later part of 2006 recorded a remarkable performance. The Mining Index (one of the two indices in the country) for example, moved from a low of 100,000 points to over 400,000 points in less than six months while the Industrial Index is past the 600,000 mark.

However, with most stocks being overvalued, there is more profit taking than fundamental/value investing. Investors are wary that any move by the reserve bank to hike interest rates could be a big blow to their investment. To counter such happenings, investors will sell off their shares at the remotest information available in the market and buy them back if the information turns out to be a hoax.

With inflation always hitting crazy highs, investors at Number 80, Samora Machel Avenue are wary of any government announcement that can easily prick the equity market bubble. Zimbabwe’s equity market is mainly characterized by retail investors who are mainly profit takers. This means high activity levels in the equity market as people do not have enough money to opt for fixed income securities and other high end investment options that require more capital outlay like the real estates. That explains why recent activity has seen the equity market gain tremendously.

The country’s equity market is also facing minor interference which can be attributed to the weakness in democracy. Radar and Border Timbers, the largest timber manufacturing company in the country is considering delisting from the bourse. The company’s profitability has been greatly affected by forest fires which were set up by arsonists. Although critics claim that the company’s board is only considering an exit in order to declare huge dividends for the preferred shareholders, the uncertainties are clear evidence that all is not well.

The reality however is that the country doesn’t just have land clashes to offer. The market, like few other African ones, is open with so many opportunities. Laden with info, one would still have an opportunity to reap big returns. As we look out to Uganda and an anticipated integration of the East Africa Community, let’s not forget to tread the far South as well as West.