Atta Mills Exit: Likely Implications

|

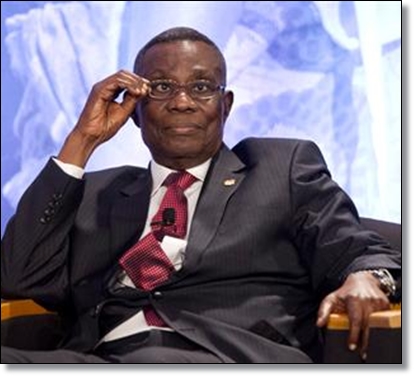

| The Late Atta Mills Photo courtesy |

Previously, Mills served as vice president from 1997 to 2001 under President Jerry Rawlings, and had unsuccessfully contested the 2000 and 2004 elections as the presidential candidate of the National Democratic Congress (NDC). During his term, President Mills adopted tight fiscal and monetary policies to reverse the large twin deficits his government had inherited from the New Patriotic Party (NPP) government in 2009, and oversaw the country’s 60% upward revision of GDP to $31bn, signaling its transition into a middle-income economy in 2009, and the debut of oil production in late 2010.

Vice-President John Dramani Mahama, 53, will serve as caretaker president until the YE12 elections. Hours following the announcement of President Mills’ demise, Mahama was sworn in as President of Ghana at 6pm Ghana time, in accordance with the constitution. Mahama will complete Mills’ four-year term, which was due to come to an end in December. Prior to becoming Mills’ vice president, Mahama, a communications expert and historian, was a member of Parliament and a minister of state.

What does this mean for the 7 December 2012 elections? At this stage, it is unclear whether Mahama will be the NDC’s presidential candidate at the upcoming elections, especially considering that Mills’ second-term bid had been challenged by former first lady Nana Konadu Agyeman Rawlings at the NDC primary in July 2011. We think Rawlings’ poor showing at the primary – the former first lady garnered only 3% of the vote – may keep her from vying again for the NDC candidacy at the YE12 elections. We think there is a low risk of the NDC introducing a new candidate, other than Mills’ constitutional successor, Mahama, or Rawlings, to contest the elections as an unknown candidate may undermine the party’s prospects at the polls.

Division within the ruling NDC

The NDC is split into two factions: the former presidential couple, Jerry and Nana Rawlings, and the party leadership. The Rawlings had accused the Mills administration of corruption and of alienating the traditional support base. The Rawlings were not expected to campaign for Mills during his second-term bid, which had been expected to result in some NDC supporters abstaining from the vote. In particular, Mills was widely expected to lose the support of the swing regions of Greater Accra, Central and Western in the south, and Brong-Ahafo in the centre, which would have denied him the majority (50% +1) vote. We think it is likely that the Rawlings consider Mahama to be a core part of the party leadership, so their view of him is unlikely to differ from that of his predecessor. But given that the Rawlings faction within the NDC does not appear to have as large a support base as the camp aligned to the party leadership, as suggested by the primary vote, we think the probability of a Rawlings NDC candidacy is low.

What does this mean for policy continuity? We do not believe the differences between the Rawlings and the party leadership are ideological, so we see a low probability of a Nana Rawlings NDC candidacy threatening policy continuity, i.e. assuming she is successful at the presidential polls. That said, we think the likelihood of a Nana Rawlings candidacy, given her poor showing at the 2011 primary, is low. On the whole, the ruling NDC is considered to be a social democrat government that is more likely to retain subsidies (e.g. on fuel), refrain from privatization and raise taxes, as it did earlier this year on the mining companies. We thus think there is a low risk of the legislation and tax regime for the extractive industries (oil & gas, and mining) being changed because the party more likely to do so, the NDC, has already done so and the business-friendly NPP is unlikely to do so. The NDC government has already increased the tax burden on mining companies by 10 ppts to 35% and imposed a 10% windfall profit tax on all mining companies.

Although the opposition NPP may be more pro-free enterprise than the ruling NDC, both parties are considered to be pragmatists and in practice are considered to be very similar. It was for this reason that we did not think there was a real risk that a Mills (NDC) vs Akufo-Addo (NPP) presidential contest would have a significant impact on policy continuity, which we had pointed out in our 13 March note, Ghana: Trip notes – Growing arrears risk. We continue to hold this view even though there will be a new NDC presidential candidate following Mills’ demise. We may, however, see a slowdown in the planned infrastructure programme if the NPP were to win the elections, given that the opposition party believes the government has contracted new loans (from China) and commissioned new projects without proper accountability.

Cedi likely to come under strain due to political uncertainty

Mills’ demise, a mere five months before he was due to run for a second term in office, is likely to raise political uncertainty, in our view. Mills’ clear win over Rawlings at the July 2011 primary laid to rest uncertainty over the NDC candidacy. It also clarified the identity of the two main presidential candidates – NDC’s Mills and NPP’s Nana Akufo-Addo. Mills’ death again raises the question of who will be the NDC’s presidential candidate. We think heightened uncertainty will result in some foreign investors taking a wait-and-see stance, which would imply a slowdown in FX inflows, which in turn would be negative for the already troubled cedi – the currency has depreciated by c. 20% YtD, to GHS1.96/$. We think 5-10% depreciation is likely by YE12.

Upside risk to yields on Treasury securities, as the rise in political uncertainty tempers foreign interest in local currency debt. We think a slowdown in foreigners’ participation in Treasury bills and bonds, combined with the projected increase in domestic borrowings owing to the upward adjustment in the budget deficit by 2 ppts to 6.8% of GDP, as proposed last week in the supplementary budget, implies higher yields. We believe this will be negative for credit growth, as it would discourage lending, and for the equity market.

By Yvonne Mhango

[email protected]

© 2012 Renaissance Securities (Cyprus) Limited. All rights reserved. Regulated by the Cyprus Securities and Exchange Commission (Licence No: KEPEY 053/04).