Kenya: Falling Shilling Calls for System Overhaul

|

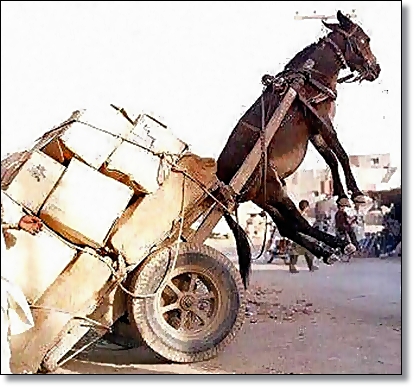

| Kenyans are overloaded Photo courtesy |

A market driven economy does not necessarily surrender to market forces, but harnesses such forces to favor its interests. Solar, wind and river energy cannot serve one’s interests unless it's harnessed. Wealthy nations harness market forces (even in the financial sector) to favor their interests. For example, a weak dollar or Japanese Yen works in favor of the United States of America and Japan because they are keen to promote exports to other countries. On the other hand, Kenya which is a net importer of products religiously "surrenders" to market forces because it relies on donors (the exporters) to finance imports.

The motivation behind this "surrender" when the country is drawing closer to an epic election season under the new constitutional order raises more questions than answers. Are essential goods being hoarded to artificially increase prices? Have Kenyan political elites become currency traders? Have Kenyan elites colluded with international elites (exporters) to sustain the country on food imports at the detriment of domestic agricultural productivity?

Such questions among others are fueled by the fact that whilst international prices of say, oil, maize and sugar are lower; Kenya continues to have higher prices and more so a guaranteed government higher buying price for maize. The general perception is that elites with foreign dollar accounts and export business stand to gain in the current weak exchange rate regime.

The pressure exerted on the Kenya shilling by international currencies exposes the urgent need for a functioning rule of law regime. Watching proceedings at the International Criminal Court, it is clear that the Western world evolved a system to promote accountability through due process as opposed to blaming amorphous forces for ills in society. The Kenya shilling is on a free fall: blaming drought and global forces does not help the country evolve a culture of accountability. Those charged with managing the country's financial system ought to be probed in order to provide clear reason for the state of the economy.

An objective due process would reveal for example, why Kenya is keen to increase state sanctioned imports to fix the country’s challenges as opposed to state sanctioned Mwananchi productivity initiatives. For instance, it is more lucrative for political elites to import food to feed the hungry than get Kenyans producing their own food. Kenya has imported relief food to feed 2.4 million people and plans to up this number to 4 million people (This figure excludes imported food that goes to the open market). An incentive exists for operatives to increase the number of people on imported relief food than to have it reduced.

Domestic Responsibility

Whereas global factors impact on Kenya’s economy, a keen analysis points at the need to evaluate domestic responsibility for inflation and weak shilling. Fuel prices play a significant role in Kenya's inflation but the country has no clear policy on fuel distribution. This leads to unnecessary shortages, delays and increased costs. This then drives up production costs and the cost of imported grains when it hits the local market. Increased cost of living puts pressure on wages, and majority of the employed class (middle class) then fails to support their families in rural villages. Shortage signals then go to importers as opposed to Kenyan producers because of the prevailing weak and unsupportive policy to producers.

Deficiencies are not only in the fuel distribution system but also at the point of entry in Mombasa. Despite the Kenya government allowing duty free imports of maize; congestion at the port may not help stabilize prices once the 744,148 metric tones of maize hit the market. In other words, even with enough food supply, Kenya still faces the challenge of how to distribute it across the country. Supply constraints are not limited to infrastructure and inefficient ports but also insecurity.

A recent advert announcing the cancellation of "The Great Turkwel Race & Cultural Beauty Show" due to insecurity failed to elicit public scrutiny on the state of the nation. Insecurity is treated as "normal" and so is the weakening shilling. Those charged with responsibility are either too busy positioning themselves for the impending 2012 elections; defending themselves at the International Criminal Court or simply waiting for instructions from international finance institutions. While the Kenyan consumer suffers increased cost of living; the Kenyan producers suffer increased cost of inputs as the currency trader smiles all the way to the bank.

The current financial system that obligates leaders to international financial institutions needs an overhaul. Kenyans ought to query relevant institutions such as the parliamentary oversight committees that have remained tight-lipped even as the shilling goes berserk. To put "substance" in its shilling, Kenya ought to make good use of its educated workforce and access to the ocean to produce, consume and export products. It's important to develop a culture that queries economic growth statistics to nurture accountability. To blame the Kenya shilling's free fall on market forces is to let those charged with managing the country's financial system wallow in impunity.

By James Shikwati.

The author james@irenkenya.org is Director of Inter Region Economic Network