Stock Market Sending Distressing Signals

In the recent past, we have witnessed a stock market publicity that never was. This came in with the government’s bid to relinquish control of the KenGen power company through the Nairobi Stock Exchange (NSE). This has seen many unlikely investors try out their luck in the much hyped bullish NSE. Like in many developed stock markets, this is set to see improved performance of the NSE that had less than150, 000 investors out of a potential investing population of 5,000,000 people. In addition, there is a potential for high growth due to the high liquidity in the market. This is already being witnessed as was seen with the drop of the 91 day Treasury bill rate from a high of 11% to 7%. This liquidity will be caused by a plethora of factors. Among them are the over Kshs.13 billion refund to KenGen share-subscribers which is set to drive the cost of funds even lower.

The question is; are our market analysts in the NSE giving the correct indicators? Is our NSE 20 Share index giving the correct chart? According to Odhiambo Odera of Nairobi University, investors’ concern with the index gets conspicuous whenever other market indicators such as volume of shares traded and value per transaction are on the increase, yet the index is on the decline. Such a trend sends confusing signals to the investing public and corporate managers.

Evidently, there is an uneven movement in the market often caused by the over-speculation by the dealers in the stock market. The NSE 20 Share index comprises of mainly blue chip and high cap stocks which according to research do not perform well.

The NSE 20 Share index measures the average performance of 20 large cap stocks drawn from different industries.

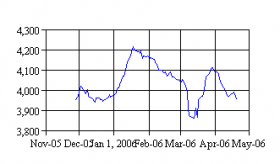

|

| NSE 20 share index performance in the past 6 months - Source: www. firstglobalselect.com |

Whereas empirical evidence shows that most large cap stocks do not record a high performance as compared to low cap stocks, small caps can at times record growth averaging at between 20 and 50 percent while this is unlikely for large cap stocks.

For sector specific reasons, the 20 Share index is biased to a large extent. Take for example the Agricultural Sector. Early this year, news had it that the coffee and tea sectors had reported millions in losses. Going by the fundamentals, this would have caused a stir in companies like Williamson Tea (Alternative Investment Market Segments), Kakuzi and Sasini Tea (Agricultural Sector) - and they really did. Their stock prices have since stagnated recording only slight increase or declines. Such performance would have a major effect on the overall market. However, the agricultural sector would be considered as well represented in the Index. This is because most companies in the agricultural, other than Rea Vipingo Plantations (NSE: RVP) are in the food and beverages business. Rea Vipingo is a sisal plantation farm.

The Commercial and Services sector has around 4 companies included in the index. Out of these, two companies can be rated as excellent performers- Nation Media Group (NSE: NMG) and Kenya Airways (NSE: KQ). Still in the same segment, Uchumi Supermarkets Limited (NSE: USL) has performed poorly reporting a drop of over 46% in one month. Left out are companies with good growth models like CMC Holdings and TPS Serena.

The Finance and Investments segment too presents a similar scenario. With most stocks in this segment being high cap, one wouldn’t expect much. Barclays Bank and Standard Chartered Bank are the main companies in the segment. Notably, their high prices do not attract a lot of trades from small investors who dominate trading. Indeed, smaller cap companies are more active thus present a better market indicator than the large cap companies. This has been witnessed by the performance of Housing Finance (HFCK), Jubilee Insurance Company (JIC), Industrial and Commercial Development Corporation (ICDC), National Industrial Credit Bank (NIC) and Chartered Finance Company (CFC). These companies are all excluded from the index.

On most trading days, the Industrial and Allied is the main market mover. Included in the index from this segment are companies like Bamburi, British American Tobacco(BAT), East African Breweries(EABL), Kenya Power and Lighting Company(KPLC) and Total Kenya. In the recent past, trading in the NSE has been dominated by Sameer Africa Limited and East Africa Cables. Leaving out such great performers therefore signals bias that will have an effect on the bottom-line results reflected in the index.

In its present form however, the NSE 20 Share Index has one advantage. The growth of large cap stocks is more likely to be influenced by fundamentals than the growth of small cap stocks (mostly influenced by technical analysts/chartists). This is because the small caps are very speculative due to their low prices. Investors will buy low priced stocks in anticipation of price increases. Conversely, they will shun the high price stocks because they lack the volume advantage.

To be effective, an index must be accurate and effective. The NSE 20 Share index is by all means biased to stocks whose performance do not reflect high growth and emerging stocks. In addition, an index movement must correspond to all underlying price movements at the market for it to be accurate. Where there is no correspondence, cause may be as a result of the bias. This therefore misleads the parties who rely on the index for decision making.

According to Ross (Stock Market Indices in The New Palgrave), indices must satisfy two criteria for use as benchmarks of performance. One of those measures is the measurability (attainability). The other is the investment realization criterion. Their movement must describe the actual movement in the financial asset and the returns on the index are realizable by an investor who has formed and held the index.

Including a share in an index has lots of advantages as discussed by Fisher and Dieward. One of these advantages is the price pressure. On inclusion in an index, a stock price increases due to increased demand in that stock. Secondly, it leads to the imperfect substitute’s theory which generally states that the performance of one stock cannot be substituted with another. Thirdly, there is increased market liquidity, a direct effect on increased trade volumes. Finally, there is the information hypothesis, an argument in favor of what investors see in a company when included in an index – usually a positive signal about a company.

In the recent past, there has been very little effort done to this effect. The Capital Markets Authority (CMA), the regulating body of the stock market has still not opened its doors for innovation. In addition, it is not likely to open up until 2009. The American International Group (AIG) has made efforts to this effect and come up with the AIG 27 Share index. However, its performance is not much different from the NSE 20 Share Index.

The United States has had many stock Indices being developed to capture every segment. Among the existing indices are the Dow Jones Industrial Index (measures 30 companies), the oldest stock index, the Standard and Poors 500 Index (measures 500 companies), the NASDAQ Composite Index (All Stocks on the NASDAQ Stock Exchange), the Wilshire 5000 Total Market Index (contains over 6,500 stocks that trade in the US), the Russell 2000 Index among others.

Given a chance, market experts could come up with multiple indices that different classes of investors can use in making investment decisions. Regionally, the Johannesburg Stock Exchange (JSE) of South Africa joined forces with the FTSE 100 (United Kingdom) to come up with two new indices the FTSE/JSE AltX Index and FTSE/JSE SA Resource Index. Where as the former measures the performance of AIMS, the latter measures companies in the Oil and Gas Production and the Mining Sectors. Our pace of innovation is very slow and we could do if the CMA opened room for innovation as we belt out for more listings in the coming months.

I am currently working on a stock market index set to achieve what the best global indices have had. Any contributions and support in relation to this are welcome.