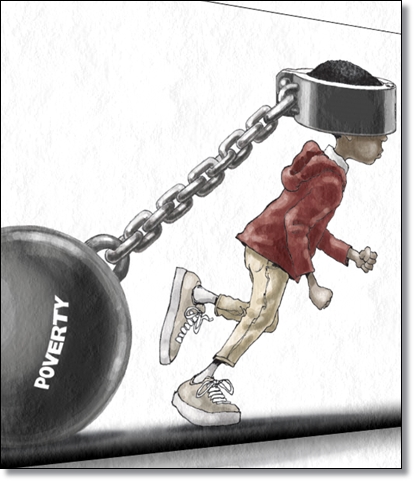

Poverty Eradication : The Elusive Dream

|

| Graphics courtesy |

To escape material poverty, people first need decent incomes. Second, the taxes, leakages and costs of living must be manageable relative to those incomes. Finally, people must have the knowledge to deploy savings productively to sustain their escape from poverty.

Let me be clear: while the World Bank defines absolute poverty as living on less than US$ 1.25 per day (say Kshs 3,000/month), this opinion piece is premised on the fact that poverty is the absence of savings or material wealth. Using a simple equation: Wealth = income – taxes – leakages – costs of living.

The components in more detail

First, it is clear that the starting point is income and the most common sources of income are employment, business, investment, and welfare, with employment by far the most prominent. The quantity of income dictates if one should barely survive, live a comfortable life or combine a comfortable life with saving. The most effective way, therefore, to tackle poverty, is to create high paying jobs and to equip people with skills to fill them. Creating jobs without developing local skills pulls in expatriates. Conversely, developing local skills without the jobs could lead to mass emigration (as in Zimbabwe), innovation (as in China) or social unrest like the Arab Spring. Equally important sources of jobs (and taxation) are businesses, like SMEs in agriculture, manufacturing and service sectors. FDI is known to leverage the creation of SMEs.

If a government gives people skills, access to finance and a conducive business climate, they tend to help themselves, others and the government out of poverty. A good environment allows those with resources to invest in equity/ shares, savings and deposit accounts or bonds to derive dividend or interest income. Investments earn incomes and give others the capital to produce more. Some people earn income from a combination of sources. However, some will always be left behind be it due to vulnerabilities arising from disability, discrimination, socio-cultural or even economic causes. Responsible societies have an obligation to help those left behind by providing welfare income.

People’s ability to earn an income, therefore, depends much on the efforts of the government. Governments greatly influence the investment climate, access to finance, quality of skills, employment, migration, disposable incomes, and welfare programs. Also important is the behavior of individuals themselves and the international community (aid, trade, loans and FDI among others).

Second, tax represents mandatory direct deductions that governments impose on incomes. Being the lifeline of governments, some believe it is the second surest thing to death. Most governments use scaled percentage rates to tax which make tax progressive so that those who earn more pay more in absolute terms. Higher taxes may enrich governments and impoverish citizens (socialism) while lower and more progressive taxes may lift people out of poverty. Smart governments win by widening the tax base, for example, by growing the economy and enforcing compliance to share the burden thinly across a bigger universe. They also ensure that taxes collected are not only shielded from leakage, but are also directed into very carefully targeted causes of public good. While governments directly control taxes, citizens have a moral obligation to play their civic duty.

Third, leakage presents a unique cost mainly to developing societies mired in insecurity, poor infrastructure and corruption. They are additional costs people incur say to establish and run businesses, secure and maintain jobs, protect themselves and obtain services. It is what corruption and wastage cost us. High leakages lead to higher costs and prices which escalate poverty. For SMEs, bribes have to be paid for permits, goods are stolen, staff are connected but less productive, power and security need back up and transport costs are high, amongst other challenges. For citizens, bribes have to be paid to procure goods and service. In well managed societies, such costs are minimal. Leakages cannot be avoided and thus rank just below taxes in necessity. People would rather sacrifice savings or quality of life to pay for them. They eat into what would have been saved and re-invested. Governments greatly control leakages although the moral compass of society plays a role too.

Fourth, costs of living are what we all easily identify like the cost of food, shelter, security, utilities, health services and education, among others. The amount we pay for these is a function of many factors. For a start, the public goods that the government provides matters. If it provides good infrastructure, security and basic services, what the individuals have to pay on top of taxes reduces. Simply put, if corruption is eliminated, mothers accorded good healthcare and my nieces given good education, I will save and re-invest more. Of course it costs more to provide more and what smart governments do is to tax progressively and supplement direct taxes with investment income and indirect taxes like VAT, sales tax and tolls. These ‘pay-as-you-consume” taxes are voluntary in a way but their benefits spread to more people. Governments also use grants and cheaper borrowed funds from say the Bretton Woods Institutions, development banks, friendly nations, organizations and partners up with the private sector to lower the costs of basic services and develop infrastructure. The more government does here translates into savings by the citizens who have to pay the residual costs.

The hand of government in these costs is far reaching. If goods and services are imported, it determines the excise and custom duty, other levies and leakages, all of which are passed to consumers. For locally produced goods, the incentives that governments provide and the taxes they levy determine their final prices. Governments can regulate prices or subsidize some goods and services. If the cost of living is high, more people sink into poverty. Conversely, if it is low, more people are lifted out of poverty. The government can raise a tide that lifts all boats (citizens).

Finally, savings or wealth is what remains from income after paying for all these. It is the future cushion against poverty. Ballpark figures show an average American can save 25% of income, a Briton 15% and a Kenyan 5%. However, I must caution that individual preferences are vital. Some people are extravagant, others measured and yet others frugal. Personal preferences affect what you save and the productivity of your savings. We can squander, protect or invest savings. BRICS nations partly use frugality to overcome poverty, China has invested its savings into a fortune and Eastern Europe is squandering its wealth back into poverty.

It is therefore clear that the best way to eradicate poverty is to develop jobs, skills and the investment climate so as to enhance incomes and at the same time minimize taxes, leakages and costs of living, while providing welfare to the most vulnerable. All these greatly depend on the actions of the government, and right there are the priority entry points for any responsible government to tackle poverty.

By Morrison A. Muleri FCCA, PhD

The author mmuleri@yahoo.com is a chartered accountant and holds a PhD in development effectiveness besides other qualifications. He works for a leading development organization in Washington DC. The views expressed here are entirely his own.