The Poor in Africa Not a Curse

|

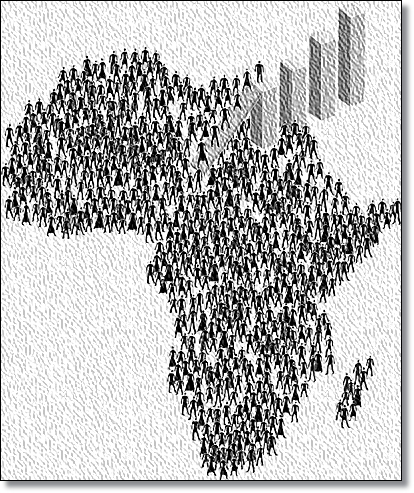

In his book “The Bottom Billion,” Paul Collier raises the alarm about countries and populations at the bottom of the global economic system that are likely to form a “ghetto of misery and discontent” thereby breed instability. Trapped in conflict, natural resource, landlocked with bad neighbors and bad governance; the bottom billion, 70% of whom are from Africa, are a potential threat to the secure world at the top of global economic system. It is a line that is shared widely by political and policy leaders. Industry players have a different take on this – they see opportunity trapped in the bottom billion.

One of Kenya’s leading indigenous banks has dived deep at the bottom to rake profits. Equity bank’s model that targets low income market of the unbanked and under-banked populations demonstrate that the bottom billion are not always a bag full of threats. The bank opened up its retail and micro-loans of as little as Ksh 500 to a customer base that other banks were running away from. For the last 14 years, its pretax profit has grown at a rate of 65%. The bank has grown to be among Kenya’s pioneering multinational companies with branches in Uganda, Tanzania, Rwanda and South Sudan.

Equity Bank’s model illustrates the fact that the poor are not necessarily beggars. Access and affordability surfaces the dignity of the low income groups and propels them to productive populations. Financial inclusivity model acts as a force multiplier that enables rural communities to increase their productivity and set up enterprises.

Equity Bank’s entry into mobile banking with a keen eye for low income populations reinforces the view that the bottom billion have a lot to offer innovators. The thin sim card technology that Equity is rolling out will scale up numbers that access financial services by riding on existing mobile phone company platforms. Competition with Safaricom, an old player in the mobile money sector, is likely to benefit low income populations with falling prices of financial services and better customer service.

As innovators turn to the “bottom billion” for profits, government regulators must keep with the pace as well. Governments should not focus only on the tax that such innovations generate for the economy but ensure that citizens are not shortchanged through poor services. With Equity Bank’s move to break Safaricom’s monopoly, the Kenya government’s role as a “referee” is going to be keenly scrutinized. Kenyan consumers expect the government to play its proper role to foster fair competition.

Equity Bank’s success story should encourage more Kenyans and by extension Africans to venture into business to serve the people. The bank’s success story is not pegged only to its focus on low income populations, but its strategy to partner with successful ventures to deliver promise to its clients. For Kenya and Africa to succeed, they too have to learn how to manage and navigate strategic partnerships as opposed to the attitude of shunning the rest of the world. The country’s challenges offer opportunities to innovators to step in and reap rewards.

The bottom billion are not a curse or threat to society. They offer opportunities for innovators to make profits. Equity Bank has demonstrated that innovations and technology can get rid of “poverty traps” that hold back low income people from connectivity to the global economic system. Instead of fearing the bottom billion, the world should reconfigure and remove the restrictions that suffocate low income populations. Market horizons are not cast in stone so as not to be grown!

By James Shikwati

The author james@irenkenya.com is Founder Director of Inter Region Economic Network (IREN).