Is Islamic Banking a Better Option for Africa?

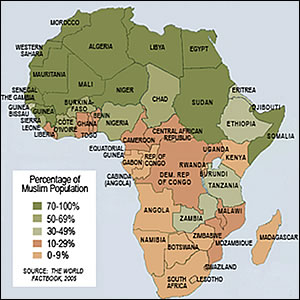

Africa is probably the second most Islamized continent in the world with most of its northern countries fully Islam. In many Islamic countries, the ‘modern-European’ mode of banking has been shunned for condoning of interest (usury). Most banking institutions in Africa countries have based their earnings largely on interest. This left no option for the Muslim population.

Africa is probably the second most Islamized continent in the world with most of its northern countries fully Islam. In many Islamic countries, the ‘modern-European’ mode of banking has been shunned for condoning of interest (usury). Most banking institutions in Africa countries have based their earnings largely on interest. This left no option for the Muslim population.

Over the years, Islamic banking whose principles differ substantially from those of conventional banks has evolved. It prohibits usury and collection or payment of interest. Islamic finance products are based on risk-sharing and profit-sharing. Such principles provide acceptable financial returns to investors by providing potential profit in proportion to the risk assumed.

Out of dire frustration by banks which purport to offer Islamic banking services, a Muslim friend of mine had to open an account with National Bank of Kenya which does not offer any Islamic services. Apart from Kenya's Barclays bank Kenya and Kenya Commercial Bank (KCB), no other bank was willing to provide Islamic banking services until just recently when Gulf Bank from Kuwait opened its two branches in the country.

Clearly, Islamic banking in Africa has a big untapped niche. With over 50% of the population in Africa being Muslim, Islamic banking services are bound to grow at a very fast rate. This will ensure satisfied clients both financially and spiritually. In the sub-Saharan part of Africa, the population tends to be largely Christian. Consequently,banking services are skewed towards the ‘modern-European’ style. But even with this, the Muslim populations in these countries still create a considerable demand for Islamic banking services.

In Kenya, Uganda and Tanzania, the Muslim population commands a sizable number that cannot be ignored. In most sectors of the socio-economic setting, Muslims are a force to reckon with both politically and socially. Several muslim communities from the Kenyan northern part have established themselves as shrewd business persons. A good example is the vibrant business hub Garrisa lodge in Nairobi that is one of the centers largely for Somalis’ and Borans’ from north eastern province. Enormous amounts of business takes place in this center that several banks have literally opened their branches there including multinationals such as Barclays Bank, Standard and Chartered Bank and the new Islamic bank Gulf Bank.

In this case, demand is not the issue but supply. While the demand for Islamic banking services has continued to grow in leaps in Africa, banks have been dragging their feet in offering these services. An excuse can be given that they lack expertise or knowledge to operationalise such services but time will hold them accountable for lack of interest to train or source qualified expertise.

Although Islamic banking prohibits interest and involvement in economic activities which are morally and socially injurious (such as alcoholism and gambling) it does not stop the banking institution from engaging in other profit making activities. The bank is allowed to make profits on behalf of its clients as long as the two have set down a sharing agreement on the profit or loss made from the investment. Among other things, the bank can still engage in other joint ventures and leasing activities for profit. These ensure that the demands of investors in the contemporary environment are satisfied within the guidelines of the Islamic Laws and ethics is observed by the banking institution.

The uniqueness of the Islamic banking principles makes it a perfect alternative for traditional banking system that leaves a larger part of Africans unsatisfied. Islamic interest free mode of financing provide a better competition but can still coexist with interest-based conventional financing to ensure the African population is properly served.