Zimbabweans Pursue 'World Diamond Capital' Benefits

|

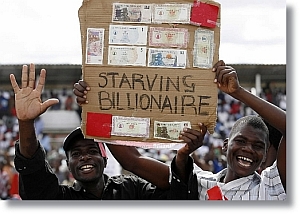

| Zimbabweans want meaningful gains Photo courtesy |

As Zimbabwe prepares to become the world's largest diamond producer, accounting for over 35% of global supply, it is crucial that Zimbabwe creates an Indigenous Diamond Beneficiation Strategy, within the impending Diamond Act, that will ensure that the people of Zimbabwe maximise their benefit from this resource.

The discourse surrounding diamonds must move from the discredited narrative that our detractors have distracted us with, and towards answering concrete questions about how the people of Zimbabwe can truly benefit from their God given birthright. This shift in the public discourse should be centred on firstly, how Indigenous Diamond Beneficiation would allow Zimbabwe to maximise its benefit from diamonds. Secondly, the means by which the people of Zimbabwe, through their elected representatives, can ensure that the impending Diamond Act can create the necessary conditions for beneficiation. Finally, how Zimbabwe can become the World Diamond Capital by capitalising on De Beers' loosening grip on the industry, continuing to stave off detractors, and overthrowing the status quo.

Indigenous Diamond Beneficiation

Under the status quo, Zimbabwe will sell its diamonds at say $370 per carat, only for the Israelis and Belgians of the world to cut, polish, process and sell Zimbabwean diamonds at $2000 per carat. However, if Zimbabwe was to focus on Indigenous Diamond Beneficiation (IDB) the current stockpile, worth an estimated $1.7 Billion, would indeed be worth in excess of $10 Billion.

The global value chain of the diamond industry includes exploration, mining, sorting, polishing, dealing, jewellery manufacturing, and ultimately retail. Zimbabwe is able to conduct the first three stages but must focus on mastering the other four. In a nutshell this mastery is beneficiation.

Beneficiation will allow the nation to be vertically integrated with each stage of the global value chain such that each stage occurs within its borders. Such integration is crucial because the mark-up value of diamonds increases exponentially as they pass through the links of the global value chain. In fact, cutting and polishing adds around 50% to the value of rough stones as well as much needed employment creation. The world market for rough diamonds is currently valued at $19 billion annually, while the retail diamond jewellery industry is estimated to be $90 billion.

Conservative estimates are that rough diamonds in Chiadzwa could earn Zimbabwe up to half a $Billion per month, becoming by far the largest foreign currency earner. The importance of focusing on beneficiation lies in the fact that were Zimbabwe to cut, polish and retail the gems internally this figure would quadruple. Currently, the government is struggling to deliver services on a meagre budget of US$100 million per month. Set alongside this, revenues from Chiadzwa have the potential to transform the nation’s fortunes.

Beneficiation within the Diamond Act

Lawmakers and Government should not embrace Indigenous Diamond Beneficiation out of some misguided enthusiasm or altruism. No, they must embrace it because it makes good business sense and because it is the right thing to do: it would both serve the purpose of circumventing illegal economic sanctions and empowering indigenous Zimbabweans.

Broadly speaking, lawmakers must craft a Diamond Act that aims to achieve these purposes by regulating control over possession, the purchase, and sale of diamonds, the processing and the export of diamonds. However, as far as IDB is concerned, the Diamond Act should focus on three main areas: growth, empowerment and specialised knowledge.

Firstly, regarding growth, the Diamond Act must aim to keep as large a percentage as possible of Zimbabwean-mined diamonds in Zimbabwe, with the goal of encouraging a local diamond processing industry. The Diamond Act should therefore make it exceedingly difficult for Zimbabwe's uncut stones to be shipped elsewhere by levying an export duty on exports of unfinished diamonds.

President Mugabe has shown leadership and foresight on the issue and recently stated that, ''local beneficiation of diamonds in Zimbabwe shall be encouraged through mechanisms that will require producers to set aside some 10 percent of their diamond production for local cutting and polishing, as well as jewellery manufacturing.'' However, Government must ensure that this percentage is flexible and as Zimbabwe's diamond processing capabilities improve, the percentage should be raised until all rough diamonds are retained within the nation's borders.

Secondly, regarding empowerment, the Diamond Act must ensure that diamond claims are apportioned in a manner that both empowers small-scale miners and provides incentives for large joint venture partners. Thus far, only a paltry 3000 hectares of the approximately 66,000 hectares that are potentially diamond rich have been allocated. It is imperative that Government accelerates the provision of diamond claims to small-scale miners, not only to empower the local population, but also to provide a broad based catalyst for economic growth.

With respect to large-scale mining companies, Government must strengthen the ZMDC so as to provide potential international joint venture companies with a strong local partner. Lawmakers must also be prepared to go to extra lengths to ensure that in future beneficiation becomes a necessary condition for the granting of any diamond claims.

Thirdly, concerning specialised knowledge, the Diamond Act should provide for an Indigenous Diamond Beneficiation Fund designed to provide young Zimbabweans with access to intensive training in diamond cutting and polishing abroad. Given the current lack of local cutting traditions and schools, this initiative will bring design and service knowledge back to Zimbabwe, so that the quality of cut diamonds is up to the industry standards.

Locally, however, for full Indigenous Diamond Beneficiation to work, thousands of skilled Zimbabweans will be needed to process the gems and therefore government must make a commitment to creating local schools and institutions to provide the workforce with the necessary skills. One such encouraging commitment made by Government, is work toward a multimillion-dollar Diamond Technology Centre that will have the positive effect of centralising control over diamonds. This Centre will serve the important fiscal control functions of enhancing accountability, minimising leakages and enabling government to value and tax mined diamonds more accurately.

The De Beers Empire's fall from Grace

Ever since Zimbabwe was under the bondage of colonial misrule it has failed to prosper from its natural resources--human and mineral--while the companies that mine or otherwise employ those resources have. One such company, De Beers, founded by Cecil Rhodes in 1888, has seen its influence on the diamond industry dwindle. Thus providing Zimbabwe with the opportunity to use Indigenous Diamond Beneficiation to allow it to become the World Diamond Capital.

Within the region Botswana, Namibia, and South Africa have, in fact, tried to become Global Diamond Centres by working towards IDB but, unsurprisingly, Antwerp, London, Tel Aviv and De Beers have thrown spanners into the works. Primarily by exploiting the fact that these African nations have exclusive long-standing contracts with De Beers under which De Beers currently exports almost all of the diamonds it mines in Africa to London for resale through the De Beers marketing arm, the Diamond Trading Corporation (DTC).

The DTC, which sells just under half of all diamonds in the world, is the primary means by which De Beers exerts control over the market. However, De Beers' stranglehold on the industry is loosening, as it used to market over 90% of the world's rough diamonds, but that figure has shrunk to 40%. A significant shift to local beneficiation could further weaken the DTC's control and set an example for the rest of the continent, paving the way for African nations to gradually gain full control of the entire diamond value chain.

Genuine fear of this possible seismic shift has led to Foreign and Commonwealth Offices, politically active NGOs and those who have vested interest in preventing Zimbabwe from attaining economic autonomy, predictably throwing mud at the idea of local diamond beneficiation. These voices claim that it is cheaper to cut diamonds elsewhere and that Zimbabwe will simply not be able to compete for price and quality against centres such as India, Belgium and Israel.

A prominent De Beers managing director has come out and said that profitable mining companies do not make cost-efficient diamond manufacturers: ''stick to what you know best, dig up the stones, and sell them to us. Let me just remind you that it is not common practice to build a uranium treatment plant near a uranium deposit.''

This scaremongering is as bereft of economic reasoning as it is ineffective. However, given how embarrassingly difficult it was for the KP to accept its own report, it is to be expected. So too is De Beers' seemingly desperate attempt to defend the status quo, long past the time when the quo has lost its status. This corporate desperation, and ZIDERA' s suspiciously sudden focus on diamonds, is indicative of the strong opposition to beneficiation Zimbabwe will face from several detractors and entrenched business interests.

This fear mongering is also indicative of fears that a fiercely nationalist, proud and indigenising African nation not only has the opportunity to become the World Diamond Capital, but also to set an example to some of its less progressive neighbours. Proud, indigenous Zimbabwean nationals are looking to lawmakers not be interested in preserving the status quo but, rather, to overthrow it.

Ultimately, to overthrow the current situation and secure long-term sustainability, Zimbabwe’s economy must diversify beyond mere production of primary goods. Hence there is hope that if lawmakers take bold and necessary steps towards beneficiation, diamonds will eventually serve as a catalyst for other industries directly or indirectly related to diamonds, like banking, jewellery making, security, information technology, and even tourism.

Therefore, for Zimbabwe, Indigenous Diamond Beneficiation is not optional, not a passing whim motivated by political correctness, but an imperative, an absolutely critical part of the country's macroeconomic policy designed to uplift its economy to provide jobs, education and healthcare for the people.

For a proud people that were not satisfied with the crumbs (or the odd black commercial farmer here and there) and crust (or distant less fertile Native Reserves) of the agricultural pie - beneficiation is inevitable. For an insolent populace that is now going after control of the lion's share of corporations across the board – beneficiation will undoubtedly be the next battle in the continuing struggle for economic independence.

By Garikai Chengu,

Garikai chengu@fas.harvard.edu is a researcher at Harvard University's Faculty of Arts and Sciences. The views expressed herein are solely his own.