Uganda and the Paradox of Plenty

|

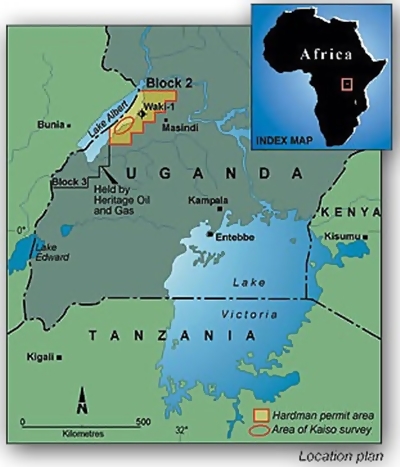

| Graphics courtesy |

As much as Uganda has the right vision on oil to invest in the newly found oil resource into infrastructure and other types of domestic capital necessary for economic transformation, the implementation precedence is worrying - as recently noted by the Global integrity report, Uganda has the largest implementation Gap in the World. Implementation gap being the deviation between strategy and actual implementation. To be more specific, e.g. the concrete debt strategy aimed at addressing arrears (commitment of government beyond its planned budgets) among others has continued to be prevalent. Also to note in relation to this, is that on the fiscal side, Government of Uganda has become accustomed to use of supplementary budgets most of which are consumption oriented( refer to the budget performance report FY 2010/11 on the ministry of Finance website). Typical non-adherence to plans, budgets among others.

The oil sector is increasingly being politicized. The president often quoted as referring to oil as “MY OIL” spells concerns of running the oil management as his own. Recent cases of CHOGM, HABA case, fighter jets purchase, among others seem to have the president as the denominator. The recently submitted Petroleum Bill does not protect the independence of the Petroleum Authority. Although the Bill provides for the independence of the authority, it also empowers the Minister for Petroleum to give ‘policy directions’ to the Authority and requires compliance to those directions. The power of the Minister in this regard is not defined in the Bill and thus political interference is an obvious risk.

Lack of transparency and accountability: The process of the petroleum bills presented to parliament on the 12th of February 2012 (bills on the website- http://www.petroleum.go.ug/ ) was non-consultative enough- in fact no public consultation was carried out on the upstream or the middle stream bill. The legislation does not contain significant oversight of parliament in the overseeing these institutions. Uganda is not yet a member of the EITI, and the bills in the current state don’t guarantee public disclosure of oil related information. Commercial confidentiality exist in these bills. The hasty signing of the oil contracts against the resolutions of parliament points to disregard of parliamentary oversight in the oil process. Lack of transparency exacerbates corruption. According to Transparency International, Uganda was ranked 80th least corrupt country in the world in 2001 but slipped to 127th out of 180 countries in 2010.

Uganda’s credible economic growth levels of an average of about 7% has not translated in to inclusive growth but rather growth bound with social economic inequalities like regional inequality have continued to grow. Refer to the UNHS 2009/10. Economic forecasts seem to indicate that a country that grows at an average of 7%, should achieve middle income status in 10 years- using the 71 principle (71 divided by average growth rate gives the number of years required for transformation.) Oil undoubtedly will likely lead to high levels of growth but non-transformative growth is what we should expect if we are to project from historical paths.(Reference should be made to similar economies in Africa such as Equatorial Guinea, DRC , and Nigeria.)

Oil resource and poor governance is a bad cocktail. Anecdote evidence from African oil economies seems to point to the realism of the likely curse on our economy. This is only conditioned on the bad political governance and is a long run phenomenon. Premised on bad governance, the resource curse is transmitted through three main channels: excessive domestic consumption, debt overhang, and real exchange rare over valuation. The resource boom when accountability is lacking allows politicians to expand public sector employment or to directly boost private consumption. Bad governance also discourages savings, increases overall spending which is normally reflected in the appreciated exchange rates. The resource rents in bad governance economies will end being misallocated and wasted as the resource base gets depleted while non-resource tradable sectors get marginalised.

In a synopsis, the risks above, if not mitigated soon enough, will lead to the paradox of plenty that will rein in on our country. The recent signing of South Sudan- Kenya pipeline deal through Ethiopia is a clear indicator of lack of trust by neighbouring countries. Uganda could potentially lose out the comparative advantage of its oil resources in the region. Tanzania recently discovered oil which increases the number of neighbours with the oil resource. Kenya too is on the hunt.

CAVEAT: Polinomics (politics plus economics) = zero economics = politics. So if the political reform supports effective extraction, production and the rest of the value chain, then oil resources could be curse-less.

By Enock Nyorekwa Twinoburyo

Ugandan based Economist.