Uganda Budget: What Gain for Farmers?

|

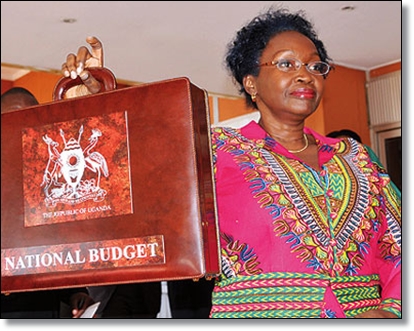

| Uganda Minister of Finance Maria Kiwanuka Photo courtesy |

The foregoing brings out two important lessons:

a) A national budget should focus on growing internal capability to generate local revenues to finance its own budget and thus reduce dependence on aid. Indeed, that we incurred $5.31 billion on importing goods and earned only $4.1billion from export of goods and services in the last financial year is a trend that we have to reverse as a country.

b) Citizens should not expect their government to provide everything. They should work to develop themselves and their country. A budget should not make people dependent on the state. A state is only a regulator and enabler.

Will the 2012/2013 agriculture budget enable the sector to grow and gain competitiveness in the region? I will hereunder provide my thoughts on Hon. Maria Kiwanuka’s budget speech.

Allocation to the agriculture sector: A UGshs 150 billion increment in allocation to the sector (from UGhshs 434.1 billion last financial year to UGshs 585.3 billion this financial year) is a positive move in the right direction. Considering the importance of the sector to food and nutrition security, creation of jobs and raw materials, agriculture should get a bigger share of the pie. What should concern farmers and those that are concerned about them is the efficient utilisation of the allocated money to transform the lives of farmers and country. Farmer groups, community leaders and barazas should develop mechanisms to follow this money. At the National level, Uganda National Farmers Federation should coordinate budget implementation monitoring efforts. Farmers must organize to engage and turn budget in their favour.

Clear targets and outcome indicators should be contained in the budget speech. For example, the National Agriculture Advisory Services (NAADS) got UGshs 52.9 billion; will this increase the percentage of farmer households that are visited by an extension worker from the current 14% to at least 30% come the next financial year? What will be the percentage of this on real agriculture productivity growth? How about the allocation of UGshs 48.9 billion to the National Agricultural Research Organisation (NARO)? Will this allocation lead to the development of coffee and banana wilt resistant varieties by the next financial year- or a report on progress? What is the projected figure of farmers that will receive wilt-free planting materials? The selection of flagship commodities like coffee, tea, maize, beans, market fruits, vegetables and fish is good for both export earnings and food and nutrition security. Remember that beans and posho have guaranteed food and nutrition security in most schools for many years. But what is our target tonnage for beans, maize, fish this financial year? Targets will be the only way we can follow and determine our performance come the reading of our next budget.

The power of leverage and smart budget applications. The budget can also be a powerful stimulator of innovations and investment from the private sector. For example, unlike the last financial year where hoes were prominent – this financial year, UGshs 500 million have been provided for tractors. Indeed, with the increasing scarcity of labour resources in the rural areas, and the rising cost of opening up arable land for production (the piece rate is averaging at UGshs 3500 shillings) this is a good move.

These tractors, once used collectively will provide a great relief. But some interesting options to consider - If we offered a tax holiday incentive to a tractor assembling company and removed all taxes and duties on tractor spare parts, we could have a cartel of interested companies that will provide tractors to farmers and farmer groups across the country at affordable rates. The same would also work for irrigation. There are companies, for example Davis and Shirtliff that produce handy and intermediate irrigation equipment. Can a tax incentive make their equipment affordable to many farmers? It is indeed viable. How about such companies working with the Uganda Industrial Research Institute to spur innovations in intermediate and high end irrigation technologies?

Allocation to Uganda Coffee Development Authority (UCDA). UCDA has been doing a good job. They scientifically realized that the reason for slumping coffee productivity and plummeting exports was due to coffee wilt, old coffee trees (above 30 years and can’t be productive), harvesting of green unripe bellies and poor post harvest handling. UCDA has been on strong campaign distributing clean planting materials and doing some progressive work on the other challenges. UCDA should have been given a bigger pie within the agriculture sector budget. I hope they can mobilize money from other sources to keep the campaign and momentum going.

Conclusion

We are reaching a time when the agriculture sector cannot be ignored. Budget numbers alone will not wholly eliminate the supply and demand side constraints facing the agriculture sector. Integrity in delivery of agriculture services will be the anchor to unlock the sector code. This is a role we can all undertake in our communities, churches and other spaces. I agree with the point of view that community leaders and church leaders at the grassroots should get back to work and re-engage the work of monitoring service delivery and mobilizing people to work. By laws that stop people from alcohol consumption at 11 am at those village trading centres should be enforced. A mix of enforcement and the market should work as pull factors to transform the rural. Lipton, 2005, argues that there are virtually no examples of mass poverty reduction since 1700 that did not start with sharp rises in employment and self employment income due to higher productivity in small scale family farms. This remains true for Uganda.

Morrison Rwakakamba

mrwakakamba@gmail.com