Tourism: Africa Braces to Reap Dividends

|

|

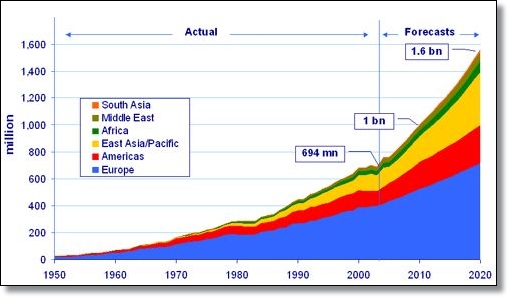

UNWTO's Tourism 2020 Vision forecasts that international arrivals are expected to reach nearly 1.6 billion by the year 2020. Of these worldwide arrivals in 2020, 1.2 billion will be intraregional and 378 million will be long-haul travellers. |

The year 2012, however, still remains a particularly challenging one: The World Travel and Tourism Council (WTTC) expects global travel and tourism gross domestic product (GDP) to grow at 2,8% this year, which is down from 3% in 2011. In terms of volume, the United Nations World Tourism Organisation (UNWTO) tells us that global tourist arrival growth has been at a strong 5,4% during the first four months of 2012. However, some flattening out is on the horizon, and, by year-end, we expect arrivals growth worldwide to have averaged out in the 3–4% bandwidth.

Traditional markets are not yet out of the doldrums, and growth in outbound travel remains flat. The American economic recovery is fragile and the on-going crisis in Europe could still draw the continent and the rest of the world into a prolonged recession. Fortunately, however, we are witnessing multi-speed growth. The emerging economies continue to drive the recovery in international tourist flows. While Europe stagnates, we, in the emerging-market economies, are boosting global tourism flows and outbound spend. By 2015, the emerging economies are expected to account for 40% of all global departures.

The rise of the Chinese outbound market as well as those in other emerging economies also tracks the global geo-political and economic rebalancing that has been under way over the past decade. This is very clearly demonstrated by what we have witnessed while the world economy doubled in the last decade, where a third of the global economic growth came from the BRICS countries.

In the next decade, emerging-market economies are, for the first time in modern history, set to contribute more to global economic growth than the developed ones. This global rebalancing, together with the spread of low-cost airlines, air space liberalisation, the removal of visa barriers and the growing popularity of online bookings, underscores that the extensive BRICS cooperation and partnership on travel and tourism among not only businesses but also governments offers boundless opportunities.

Being witness to the evolution of the emerging economies, we cannot but celebrate the unique potential of our sector to grow exponentially from low baselines over short periods. This sector is a haven for small enterprises, and, as a labour-intensive sector with a supply chain that cascades deep into national economies and communities, it is an important vehicle for social inclusion. It provides fast uptake for newly skilled workers, especially women and young people, in urban and rural areas alike. Each job in the tourism sector creates just under two jobs in the broader economy.

I come from an emerging economy where we have experienced first-hand the amazing potential of this sector. In 1993, before our first democratic elections, we had just over 3.3 million international arrivals in South Africa. Today, we have 12 million international arrivals, of whom 8,3 million are tourists. As it stands, tourism contributes 9% to our GDP (direct and indirect), and supports one in every 12 jobs in our country. And we believe the best is yet to come: Government and industry are united in their commitment to grow our international arrivals to 15 million by 2020.

The new growth will depend heavily on our marketing investment in China, Brazil and India. China is undoubtedly an important market to us, and, in 2011, we witnessed double-digit growth in tourist arrivals from your shores. We are very excited about the recent introduction of direct flights between Beijing and Johannesburg in addition to those non-stop options between Hong Kong and Johannesburg – and we remain firmly committed to ensure that tourism flows represent a two-way trade.

When the tourism industry talks about emerging destinations and source markets, my own continent, Africa, is often ignored. As a destination, the splendour of my continent’s natural riches and the warmth of our people create many truly unique experiences. We stand ready to say “Huanying” to our friends from China.

Africa is of course not only a fabulous destination, but it is also emerging as a major source market. Often, the perception is that Africans cannot afford to travel. Nothing can be further from the truth. With a population of just over a billion, with a fast-growing and rapidly urbanising middle class, I believe the African lions have arrived. Middle-class households on our continent already outnumber those in major emerging markets such as India. Half a billion people on our continent are already connected to the world through mobile devices. In a mere three years from now, there will be just over 50 African cities with populations exceeding three million. Airline passenger numbers in Africa are expected to increase from 71 million in 2011 to 150 million by 2030, at which point Africa‟s urban population of some 750 million will exceed all the current city dwellers in the West.

I have thus far focused on geographic emerging markets. Allow me to say a few words on emerging consumer markets. Today, every tourist destination with a long-term view understands that a sound growth strategy for a resilient and sustainable tourism sector depends not only on a diversified portfolio of geographic source markets, but also on a diversified and continuously innovated product and experience offering. It is about growth and creating new markets; it is about unlocking new sources of competitive advantage, and it is also about risk management and keeping pace with evolving consumer preferences.

Today's discerning consumers are demanding, and opt for ever-increasing customisation and personalised travel itineraries. A significant number of these consumers are seeking greater authenticity through experiential, interactive and specialised travel – rather than mass or „one-size-fits-all‟ package tourism. And higher internet penetration, on-line sales and the spread of mobile commerce will only accelerate this trend.

By developing balanced product portfolios that cater for the needs of emerging consumer segments, we are able to break through the ceiling of current offerings. We can create new demand (or make the pie bigger) and capitalise on niche markets that often offer more lucrative yields than mass-based markets. Of course, many of these niche markets hold huge potential, such as cultural, heritage, rural or community-based, ecological, food and wine, and health and wellness tourism. Many of these tourist activities are often located outside of traditional tourist areas. This means that more dispersed opportunities are created and more local communities are therefore empowered. In addition, niche subsectors often also require more specialised skills, meaning that better-quality jobs are created.

We have often witnessed that niche markets soon become the new ‘mass.’ It is a common misconception that diversifying into new niche segments necessarily means small volumes. Niche markets also have volume. A case in point is the China National Tourism Administration’s drive towards investment in, and the development and uptake of ‘red tourism’ opportunities in China (i.e. encouraging visits to Chinese revolutionary sites) during the year of ‘patriotic tourism’ that marked the 90th anniversary of the Communist Party in 2011. I am informed that the number of visitors to historic buildings and sites topped 360 million in China last year.

Our challenge in our respective destinations is to adapt existing offerings, leverage our current man-made and natural infrastructure, and create new unique visitor experiences that play to our strengths as we continue to compete in this rapidly evolving consumer landscape. By diversifying product portfolios, we enhance our international competitiveness in traditional and emerging source markets alike.

By Marthinus van Schalkwyk

Minister of Tourism, Republic of South Africa.