Kenya Property Market Rating: Reality or Bubble?

|

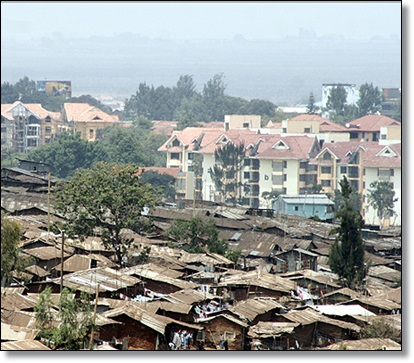

| Nairobi, a city of contrasts. |

James Hadley Chase eloquently wrote that ‘if you believe this you believe anything’ and that ‘suckers are born every second.’ Africans believe anything and suckers are born every second among them.

Nairobi, might as well be the best property market in the world. Who cares? The question is, how many Kenyans live in such houses and homes? How many such homes and houses are there? Using a small sample of data and comparing that to a large market in statistical analysis is misleading and fraudulent. The report should have said how many houses were surveyed, who owns the houses and how that compares to the local house an average Kenyan lives in or occupies. It is like using houses in Caribbean as an indicator of a small market when in totality, these are houses owned by foreigners while locals are just househelps.

Kenya does not have 5,000 homes worth an average of $1m. Assuming that number is close, half may be occupied by non-Kenyans. Using the market indicators of the very few rich and or wealthy to measure the pulse of any economy is Africa’s biggest undoing.

According to the report, undeveloped quarter-acre plots in the outskirts of Nairobi, Eldoret, Laikipia, Naivasha, Nakuru and Kisumu were fetching some $ 19, 200, up from $8,400. Let’s do the maths: A quarter of an acre is 10,890 square feet [43,560 square feet makes an acre]. Using that, the selling price of the land in Nairobi outskirts as mentioned was $0.77 per square foot. Today, the same land is selling for $1.76 per square foot. Anyone taking this rate and increase as proof of market gains is duped, naïve, and does not understand how to use and apply rates and ratios to measure significant changes in property value.

There is no way anyone can buy a piece of land in Miami, and any other city compared in the survey and/or study for the amount one purchases prime land in Nairobi. In US, using a ratio indicator of land-vs-building value, the most value one can get out of land worth say $20,000, is about $200,000, which is a typical lower middle class home in a far suburb of a major urban center. In Dallas, no piece of land considered prime is sold for less than $100 per square foot. Knight Frank, the sponsor/author of the report is misleading the Kenyan public about the true essence of the survey/report and how to use rate and ratio in measuring property market.

The Kenyan real estate market is still very small. It is not ready for prime time even though there is attraction and traction in some sector. The Kenyan real estate market does not attract significant real estate investments and no one can show that Kenya, since independence, has attracted an average of $1b annually into its real estate development sector. Property value in Kenya is like quicksand, elusive and evasive because owners cannot afford to pay an average of say 2.5% of the annual property value as real estate tax and when they pledge their real estate as collateral for loan, I do not think any Kenyan local bank can make a loan using L-t-V ratio of 85%-to-15%.

Most debts held by Kenyan banks are non-real estate because the banks have weak underwriting skills for real estate loans. No Kenyan bank has a real estate debt portfolio of $5b, which can be traded on the international market as a real estate asset back debt. If real estate is the basis of a developed economy wealth, Kenya does not show up on the radar because its real estate is in its very infancy and not seasoned.

Never be confused or excited about rates and increases when one understands statistical analysis. If a business has an annual sales of $1m and grew at 10%, it just added $100,000. If a business is worth $1b, and grew at 3%, it added $300,000. In terms of rate of growth, the $1m company showed higher rate but lower value. Therefore, when the US economy is shown to be growing at less than 3% while most African countries are doing more, say 7%, they look appealing but its value is way behind.

The foreign press/media has recognized how to impress Africans and they speak about growth increase rates instead of the value of the growth increase. It is like one going to a physician but instead of demanding a prescription based on diagnosis, tells the physician what prescription they want. Africans go looking for a prescription that suits them instead of drilling deep to see what is wrong [diagnosis] with the economy. It is what it is. Massage the numbers to see what it says and never take the numbers and run with it.

Concluding, 95% of Kenyans cannot afford houses and homes priced at an equivalent of $125,000, with supporting land value of $12,500. So using the lifestyle of mostly foreigners/westerners as indicators of a stabilizing property value is naïve, fraudulent and sends wrong signal as to the health of the local economy.

Prove me wrong.

Ejike E.Okpa II

Real Estate Analyst, Dallas, Texas.